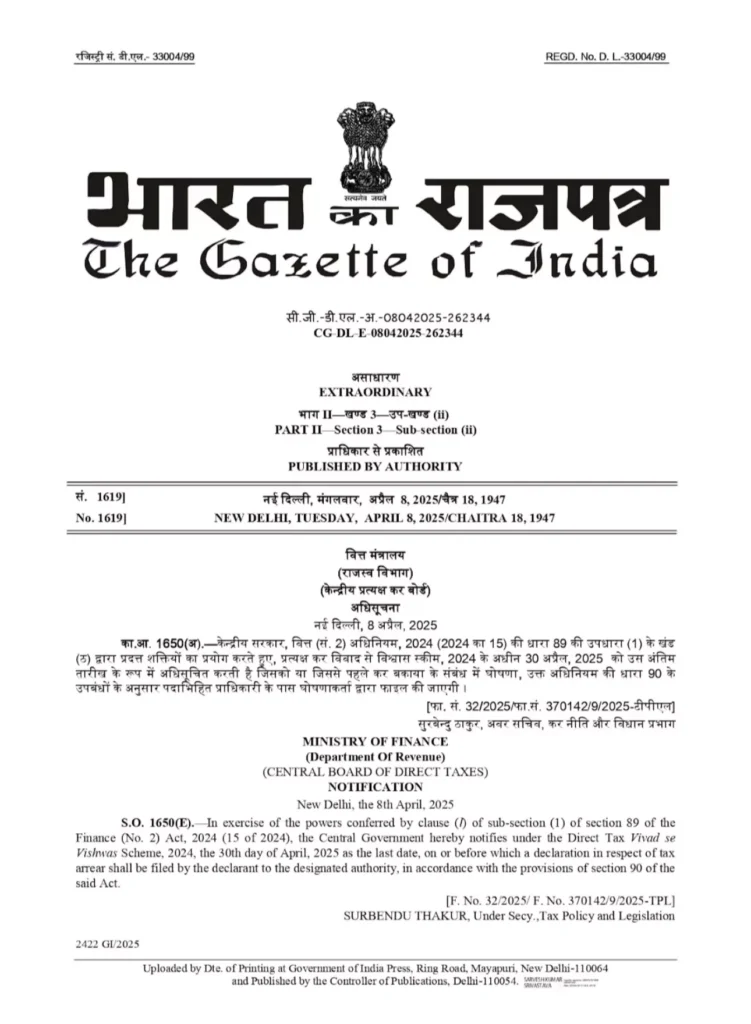

As per Gazette Notification dated April 8, 2025

New Delhi: The Ministry of Finance (Department of Revenue) vide notification published in The Gazette of India (Extraordinary) dated 8 April, 2025 has extended the timeline for filing of declarations under the Direct Tax Vivad se Vishwas Scheme, 2024 till April 30, 2025.

Vivad se Vishwas Scheme, 2024, Government programme; every one should know that the pending income tax disputes and litigation become unmanageable. This enables taxpayers to resolve their disputes for the disputed amount of tax and receive massive waivers on interest and penalties in return. The scheme will be available to all appeals or petitions pending before any appellate authority as on July 22, 2024. It does not apply in cases of search and seizure or undisclosed foreign income or assets, or in prosecution under specific laws, however.

Only the disputed tax amount due must be paid by taxpayers who filed their declarations on or prior to December 31, 2024. Anyone filing after that date and on or before Jan. 31, 2025, must pay 10% of the amount being disputed on top of the tax figure.

As a further extension of the relief provided under above notification, the Central Government has now issued Notification No. S. O. 1650(E) under clause (l) of sub-section (1) of section 89 of the Finance (No. 2) Act, 2024 (15 of 2024).

The notification number as issued is [F. No. 32/2025 / F. No. 370142/9/2025-TPL], and is signed by Surbendu Thakur, Under Secretary, Tax Policy and Legislation, and the same is published by the gazette of India under Part II, Section 3, Sub-section (ii)

Taxpayers with pending disputes are advised to seize this last opportunity of settling them and complying by boiled down to the deadline of litigation.